Culinary Tourism Strategy Development Pilots

Culinary Tourism Strategy Development

Strategies

Modules

The Tourism Industry Association of Canada (TIAC), with funding from the Government of Canada’s Canadian Experiences Fund, worked with the Culinary Tourism Alliance (CTA) from 2019 to 2021 to pilot the development of culinary tourism strategies in rural and remote destinations.

The CTA worked alongside municipal and provincial partners to co-develop four distinct and context-specific strategies to grow culinary tourism in four destinations. Across the four pilot destinations, the CTA formed four distinct teams to facilitate the strategy development processes. Importantly, each culinary tourism strategy was co-developed with tourism teams from the destination and employed a community-based participatory research approach.

Winter and Shoulder Season Tourism Strategy Development Pilots

Strategies

The Tourism Industry Association of Canada (TIAC), with funding from the Government of Canada’s Canadian Experiences Fund, worked with Twenty31 Consulting Inc. (T31) from 2019 to 2021 to pilot the development of winter and shoulder season tourism strategies in rural and remote destinations.

T31 worked alongside municipal and provincial partners to co-develop five distinct and context-specific strategies to enhance shoulder and winter season tourism in five destinations. Across the five pilot destinations, T31 formed four distinct teams to facilitate the strategy development processes. Importantly, each shoulder and winter season tourism was co-developed with tourism teams from the destination and employed a community-based participatory research approach.

Yarmouth and the Acadian Shore: 3-year strategy

The vision is to unlock Yarmouth and Acadian Shores in the winter/shoulder by taking the steps to becoming a year-round destination, especially for Atlantic Canadians.

They will be encouraged to do more and see more of the winter/shoulder products and experiences, which will step up their overall satisfaction and increase their likelihood of returning.

The vision will be achieved by balancing the needs of the people and institutions of Yarmouth and Acadian Shores and visitors, with the recognition of the importance of the visitor economy and benefiting from the expansion of the season.

Windsor Essex: 3-year strategy

The vision is to unlock Windsor Essex for visitors all-year round.

They will be encouraged to do more and see more of our winter/shoulder products and experiences, which will step up their overall satisfaction and increase their likelihood of returning in other seasons and spreading the word.

The vision will be achieved by collecting evidence to inform deliberate decisions, in coordination with our communities, government, industry and key stakeholders to expand the tourism season responsibly, unlocking long term economic and job growth.

Charlevoix: 3-year strategy

The vision is to make Charlevoix a year-round premier outdoor recreation destination.

With the breathtaking vistas and impressive outdoor recreation products, the aim is to wow the active customer market segment 365 days a year, and ensure that visitors to Charlevoix can recharge and leave feeling reinvigorated — that’s their wellness promise.

Having been identified as a priority region for tourism development by the provincial government, they will work in close collaboration with the local community, government agencies, the tourism industry and key stakeholders who impact the development of sustainable winter/shoulder season tourism in order to achieve this vision.

Sunshine Coast: 3-year strategy

The vision is to make the Sunshine Coast a year-round British Columbia destination.

Through a variety of products and experiences, visitors are encouraged to do more and see more during the winter and shoulder season, while being stewards of the Sunshine Coast before, during and after their visit.

The vision will be achieved by providing tourism leadership to stakeholders and respecting local communities, and making informed decisions based on evidence.

Winnipeg: 3-year strategy

Manitoba is a must-visit four season destination generating significant and sustainable economic growth by delivering inspiring and authentic experiences in its unique urban, rural and wild settings

Visitors, especially the regional market, will be encouraged to participate in more of the winter/shoulder products and experiences including outdoor activities and rich arts and culture scene; which will step up their overall satisfaction and increase their likelihood of returning to Winnipeg and inviting those from around the world to share in these rich winter activities.

Winnipeg and Manitoba will harness the richness of those experiences already available to enhance and package them to appeal to prospective visitors to choose Winnipeg in the winter and embrace winter as a competitive advantage for Winnipeg.

Tourism During COVID-19: April 2021

Report

Key Takeaways Snapshot

Health Impact

Globally and across Canada, new COVID-19 cases continue to rise. All regions report an increase in the number of cases, and all regions, except for Africa, report an increase in the number of deaths. Europe and the Americas continue to account for nearly 80% of all the cases and deaths. Vaccines are a critical new tool in the battle against COVID-19 and it is hugely encouraging to see so many vaccines proving successful and going into development. Working as quickly as they can, scientists from across the world are collaborating and innovating to bring tests, treatments and vaccines that will collectively save lives and end this pandemic. However, new viral variants, limited vaccine supply, and underinvestment in tools and therapies have resulted in the need to refresh the global strategy to chart the roadmap out of the pandemic.

Economic Impact

Before the pandemic, tourism accounted for one out of every 10 jobs around the world and in many places, travel plays an even greater role in the local economy. As lockdowns fell into place worldwide, international arrivals have plunged, with the economic impact of travel-related declines reaching stunning levels. In Canada, the one-year anniversary of the shutdown of the Canada-U.S. border has arrived — with unprecedented impact on lives, businesses, and communities. As the effects could be long-lasting, it is now expected that travel will not return to pre-pandemic levels until 2024.

Vaccines and Travel

As domestic vaccination rates trend upward, more people are traveling or planning to travel. Broadly speaking, proof of vaccination in order to travel is not required, but it may be in the future depending on where one is travelling. As a means to reboot the decimated tourism industry, countries and industries are considering various vaccine health passes as prerequisites of entry and travel. However, the World Health Organization has come out against the idea of a COVID-19 vaccine certificates as vaccines are not available on an equitable basis.

Tourism is the heartbeat of Canada

Redirecting foreign spend power towards domestic and getting locals to grasp the importance of supporting local tourism businesses will be critical this year, particularly as 99% of businesses in Canada’s tourism sector consist of small and medium enterprises. By keeping their tourism dollars in Canada, Canadians play a critical role in bolstering the tourism economy, creating jobs and supporting local businesses.

Remote work visas: the future of work and travel

The remote work environment has advanced extremely fast due to the state of the world pandemic. Millions of workers now have the flexibility to work from anywhere they desire. With a huge portion of people working from home already, remote work is the present, and flexible working is the actual future of work and travel. Emerging remote work visa programs have the potential to create a much more sustainable form of tourism and could potentially transform how the world works and travels.

Canadian Resident Sentiment Toward Tourism

With 80% of Canadians planning to travel when restrictions are relaxed, and data showing increasing interest in international travel search dates, the majority of Canadians are eager to get back out and explore when it is safe to do so.

Traveller Behaviours

While there is public support for travel restrictions, frustrations with the loss of freedom, feelings that quality of life is suffering, business interruptions and the mental stress associated with missing important human moments are mounting. The health, economic and social consequences of closed borders and quarantines are taking their toll, driving people to become more comfortable with managing the risks of COVID-19.

Aviation

Airlines, a leading performance indicator for the overall tourism sector, have been hit hard by the COVID-19 pandemic. With their fleets grounded and operating on severely constrained conditions, both domestic and international carriers have been devastated. Despite a rise in confidence in air travel as a result of testing and vaccination, the global aviation industry is estimated to lose more than $94 billion by the end of 2021, signaling a deeply uncertain future.

Accommodation & Events

Global and domestic business travel are unlikely to recover before 2024 with virtual meetings continuing to replace the majority of business travel. As over the past year, this will continue to severely impact the accommodation and events sector, contributing to more job losses in the tourism sector that will take years to rebuild.

Cruise

The COVID-19 pandemic and subsequent pause in commercial cruise operations has had devastating impacts on the cruise community. With strict protocols in place, and with the approval and support of local and regional authorities, cruise ships are gradually resuming operations around the world. However, even as the promise of vaccines roll out, the future of the industry remains uncertain.

Major Tour Operators

With COVID-19 continuing to influence travel restrictions around the world, tour operators have been forced to re-evaluate their plans for the coming months with many suspending operations and updating their travel policies to accommodate impacted clients. The majority of domestic and international operations have been postponed until the end of April at a minimum, causing deeper economic loss within the industry.

Download the Full Report

Canadians’ Perceptions of Domestic Travel

Report

Canadians’ Travel Preferences and Plans

Canadians’ most common preferences when travelling for leisure within their own country are for a good-value holiday focused on relaxation, often involving authentic local food and local culture and potentially including exposure to the natural world. They are relatively less concerned about combining work with leisure, high-end shopping or specialist activities. While a majority want to travel in high season, a significant proportion – nearly a third – would choose shoulder season for a trip within their own province. Despite the ongoing COVID-19 pandemic, over half say they currently have an overnight leisure trip planned – although less than one in ten of these have actually booked.

How Canadians View Their Country as a Destination

Ontario and BC remain the destinations of choice for much domestic travel among Canadians, both in terms of past travel and future travel intentions. But the survey also reveals that Canadians’ views of much of their country is consistent, and highlights its important tourism assets – all Canada’s provinces and territories are viewed as naturally beautiful, and most are also seen as having lots to see and do, including for families. Conversely, Canadians tend not to view their country as refined or crowded, and most of the country is not seen as challenging.

The three territories are seen somewhat differently – they are appreciated for their unique culture and the new perspective on the world they afford, but are also viewed as more inaccessible. At present, the COVID-19 pandemic is cited as a barrier to travel for many, with Ontario and Quebec viewed as the riskiest provinces to visit in terms of COVID-19 infection risk.

Profile of Key Destinations

When travellers are asked about their interest in visiting specific destinations within their own province and neighbouring ones, the marquee tier 1 destinations tend still to attract most interest and to be well ahead of others – destinations such as Niagara Falls, Victoria, Banff, Montreal and Quebec City. But with significant minorities expressing interest in visiting tier 2 destinations such as Drumheller in Alberta, Regina in Saskatchewan, Gananoque in Ontario and Charlevoix in Quebec, this suggests that there is potential to grow tourism beyond the well-known andover-touristed centres.

Profile and Interest in Key Attractions

Asked to rate their awareness and interest in visiting attractions within their own and neighbouring provinces, a preference emerges for natural parks and cultural attractions, as well as those associated with destinations that already have a high profile and a significant pull, such as Vancouver, the Bay of Fundy or the Rocky Mountains. The findings suggest that there is some work to do to raise the profile both of key destinations and attractions within the three territories, which tend to be relatively little known.

Other Opportunities

The survey also reveals other possibilities for growing tourism in Canada. One promising area may be to promote attractions to people making day trips within their local area, one in three of whom say they currently combine functional visits for shopping with leisure activities.

It also reveals the potential for destinations to promote themselves to the 48% of Canadians open to temporary relocation.

Download the Full Report

05 Approaching Strategy Development

Culinary Tourism Strategy Development

Guidelines

5

Opportunities

As you begin the process of developing your rural or remote destination’s culinary tourism strategy, you’ll have the opportunity to:

- Engage a diversity of stakeholders and collaborate across a range of food & drink, tourism, and economic development organizations.

- Establish a shared understanding of destination identity across the stakeholders and communities in the region.

- Build capacity amongst industry, whether it is to inspire innovation or to create new products or experiences.

- Share strategy research with those that contribute to the strategy development.

- Identify your current visitor markets and how culinary tourism can be used to appeal to them.

- Make a plan to reach new visitor markets through culinary tourism.

Importantly, part of the opportunity and responsibility of culinary tourism development is to support industry and communities to understand what culinary tourism is, what it means for your destination, and the role they can play in contributing to its development. This type of capacity-building work and engagement with industry and communities helps inform the direction of development and secure buy-in for the strategy.

Culinary tourism strategy development can also support tourism development initiatives. In other words, you can actively build your culinary tourism strategy so that it aligns with your organization and partners’ past and ongoing destination development efforts.

What types of opportunities could come from developing your culinary tourism strategy?

Approaches

Opportunities across the development of your strategy will benefit from the right approach. Defining the approach to your strategy development process ensures that you and your team have a clear direction for how the overall project will be caried out in the context of your destination.

There are a number of strategy development approaches to draw from and customize, some examples include:

| Approaches | Description |

|---|---|

| ApproachesCommunity-based participatory research | DescriptionThis approach focusses on active participation by the project team and the communities across the project. For culinary tourism strategy development it means collaboratively building the strategy methodology with partners, if being pursued in partnership, and engaging with communities and industry as active contributors to the research that will inform the resulting strategy’s priorities and way forward. |

| ApproachesCollective awareness and capacity-building | DescriptionA main focus is to build awareness about a specific topic or initiative among a range of stakeholders. This approach leans on networks and collaborative solutions for research and strategy development. Capacity-building is a main focus and can include workshops on culinary tourism and partnership development sessions, among others. |

| ApproachesTransparent and participatory governance | DescriptionGrounded in empowering stakeholders to participate in public decision-making. This approach is often used in political contexts and to improve public accountability. Within the context of culinary tourism, it points to collective decision-making processes and collaborative strategy development. |

Selecting Your Approach

There is no specific approach that is best suited for culinary tourism strategy development. In destination development, there are rarely any “one-size-fits-all” solutions, and the same is true when considering what approach fits your environmental, political, social, and cultural contexts. Regardless of the specific approach, or mix of approaches, that you choose to adopt or adapt for the development of your strategy, it is important that you ensure your approach facilitates engagement with the diversity of stakeholders in your destination. This includes opportunities for active participation in identifying assets and priorities, building awareness, and building capacity across your project.

It is equally important to actively consider the goal and objectives of your culinary tourism strategy when defining your approach. In other words, ask yourself why you, your team, and your partners are undertaking this work. Based on your answers, determine how a specific approach or mix of approaches can best support your goals and objectives.

What approach will take to develop your culinary tourism strategy?

Ownership

Before setting out on strategy development work, it is important that you and your team answer the question:

Who does this strategy belong to?

In other words, you need to build consensus around who the strategy is for, before you begin the process.

Who will be responsible for implementing your culinary tourism strategy?

Roles and Responsibilities

Your culinary tourism strategy development project team needs to account for a number of roles, key responsibilities, skills and competencies. Importantly, the team you put together needs to be comfortable scoping and carrying out work for culinary tourism development. This means having expertise in culinary tourism development.

Having a decision maker as part of the project team facilitates buy-in across your organization and supports the implementation of your strategy. Additionally, you can look to include and leverage the capacity and expertise of any existing committees or working groups related to culinary tourism that exist in your destination.

Your team should know how culinary tourism fits into overall destination development and have the knowledge or ability to learn about what makes your destination unique and how to grow it sustainably. Some key roles and responsibilities, skills, and competencies of a culinary tourism strategy development team include, but are not limited to:

| Key Roles | Responsibilities, Skills, Competencies |

|---|---|

Key Roles

|

Responsibilities, Skills, Competencies

|

It’s important to ensure that a range of perspectives are present in your strategy development team. For this, you will need to think about the types of experiences, backgrounds, and areas of expertise that you want to draw from. Additionally, across the development of your culinary tourism strategy, you will need to include the diversity of businesses, cultures, partners, and other stakeholders, who can contribute to, and would benefit from, a culinary tourism strategy.

Creating a task force to support the development of your strategy is a good method to bring in a variety of perspectives, experiences, and backgrounds. When involving industry members in your task force, consider the capacity they have to participate in meetings or to review materials. Importantly, aim to include both culinary tourism champions and new stakeholders, who may not have been involved in past culinary tourism development work, but bring equally valuable perspectives. A good practice is to identify specific individuals that you would like to include and create an invitation to participate that outlines their role and responsibilities as part of the task force. This includes the number of meetings that they will be expected to attend, and the types of contributions they will provide across the project.

Who will lead the development of your strategy development process?

Do you and your organization have the expertise and capacity to lead and facilitate the development of a culinary tourism strategy?

What cultural groups or organizations in your area need to be included across the project?

Who are the Indigenous groups in your destination who could contribute to and benefit from this strategy?

Who are the local experts invested in this work who could be engaged for the strategy?

Does your project team include a diversity of backgrounds and perspectives?

Methodology

Before designing your methodology, reflect on how your approach influences the methods and actions you will employ across the development of your culinary tourism strategy.

The types of roles and range of responsibilities needed for your project team also have a direct impact on the methods and activities you can use when developing your strategy. In other words, certain methods will require a particular type of experience or level of expertise, which you will need to make sure is represented within the project team you assemble.

Designing Your Methodology

Before starting your culinary tourism strategy process, think about how you will implement the strategy. This includes earmarking budgetary resources, identifying who will lead implementation, and determining the ideal timeline for the implementation of your strategy.

Your methodology will need to have a structure and flow. This can be achieved by breaking out the methods and related activities into phases. Since your strategy development process needs to be adaptable to context changes, consider how to remain flexible to various in-person and online methods.

Below is a list of suggestions and by no means exhaustive. It is not meant to prescribe the development of your culinary tourism strategy. In other words, they are a guide to help you customize the types of phases and their flow to correspond to your timeline, local context, the needs of your stakeholders, and complement or inform the roles and responsibilities of your team.

Work Planning

Before starting the work to develop your culinary tourism strategy, you need to plan the work ahead. Factors that will influence your work plan include:

- The approach you are taking

- The mix of individuals who make up the strategy development team

- The timeline for strategy development

- The days available across each specific team member

- The budget for strategy development

Importantly, these factors relate and influence each other. The combination that you end up with has pros and cons.

On top of considering the above factors, consider how much budget is available or earmarked for implementation and make sure that resources are allocated to action your strategy.

Work planning can take a variety of shapes, from narratives, to detailed spreadsheets, to online technologies or applications. The most important factor to consider is what tools would facilitate your team’s success. It is very likely that by looking at how your team currently works and what has worked well in the past, you will be able to identify specific tools and methods to facilitate work planning.

How are you work planning your strategy development process?

04 Goal Setting

Culinary Tourism Strategy Development

Guidelines

4

Goals

There are many reasons why you may choose to undertake a culinary tourism strategy development process, from increasing visitation to providing more meaningful and multisensory experiences to visitors.

Do not proceed with the development of a strategy until those who will lead the process have a shared understanding of what they expect to get out of it. A good place to start is with setting clear goals. Goals set expectations around the future state that is to be achieved. Because they are broader in scope, they tend to be difficult to measure. For example, you may have identified overarching goals for your strategy development project such as the establishment of a foundation for growing culinary tourism or the mobilization of industry around a shared vision for culinary tourism.

A trick for goal setting is to ask yourself, what do I want to be celebrating with others at the end of the strategy development process?

What are you trying to achieve through the development of a culinary tourism strategy?

Objectives

Objectives are clear statements that should inform your strategy development work. When agreed upon at the onset, these will greatly assist you in scoping the entire process. Put simply, objectives will guide actions that will collectively achieve your goals. The language of S.M.A.R.T. objectives is used across several industries because of how simple it is to understand and use as criteria for both setting and assessing objectives.

While there is no universally accepted breakdown of the letters that make up the term, the following has been generally accepted and adapted over time:

Specific

Measurable

Achievable

Relevant

Time-bound

Note, objectives can be process-oriented, and unique to the activities that will be taking place over the course of your strategy development process, or they can be outcome-based and focussed on the result that will be achieved as an effect of implementing your strategy research and development activities, or a mix of both. Additionally, because your objectives should be “measurable” it is important to think of indicators that will allow you to measure their success.

A trick for coming up with S.M.A.R.T. objectives is to add “To” before the action in each objective statement.

Examples of objectives include the following:

- To inventory culinary tourism stakeholders across the region

- To identify opportunities for new product development

- To garner partner interest in and willingness to support

What statements are you going to use to guide your work, keep you on track, and reflect upon at the end of your strategy development process?

Outcomes

You have decided to pursue the development of a culinary tourism strategy for specific reasons, and you have expectations that the process will yield specific outcomes. This means it is both fair and important to identify anticipated outcomes for your strategy development process.

Outcomes are clear statements of the changes you expect to take place over the course of your strategy development process and as a result of your strategy development efforts. They are what you are working towards in the immediate term, and as they are produced, you will gain confidence that you are heading in the right direction.

A trick to identifying outcomes is to think of the change you want to see take place through the implementation of your strategy.

Examples of outcomes statements include the following:

- Increased understanding of the culinary tourism landscape

- Stronger network of culinary tourism stakeholders

- Increased clarity around how to integrate food & drink into the overall tourism experience

Your outcomes may be something you report back on to key stakeholders, including partners and funders. However, there is no guarantee that anticipated outcomes will be produced; so you need to practice honest reflection throughout your strategy development process and make decisions and adjustments on the direction of your strategy and the identified outcomes.

What changes are going to take place as a result of developing your culinary tourism strategy?

06 Strategy Development

Culinary Tourism Strategy Development

Guidelines

6

The development of your culinary tourism strategy will be based on the approach you identify, as well as the goals, objectives, and expected outcomes you determine, while assessing your readiness and approaching strategy development. Your strategy will be a central resource for the direction your destination takes to grow culinary tourism. Additionally, a culinary tourism strategy is an important resource to support future projects, funding asks, and plans for tourism development.

Project Management

Communications

Clear, ongoing communication is the basis of successful project management. The importance of this begins at the onset of the project and continues throughout to its completion. You will likely need a number of communication strategies and tactics to connect with different groups, both internally and externally to the project. A key role of the project manager is to make sure everyone who should be involved is aware and up-to-date on the development of the strategy.

Within the project team, decide on how and when you will check-in, and map this across the project timeline.

Important questions to clarify include:

- Will the project team meet weekly, monthly, or in an ad hoc way?

- Will the project team meet in person or through video calls?

It is equally important that you set up a communication plan to share information with relevant parties external to the project team. This means deciding on when and how you will let people know about your project, including opportunities for engagement. Remember, meaningful engagement starts by letting people know about the project early on and sharing final outputs with everyone who contributed to the process.

Create a plan to make this happen by asking:

- Who needs to know about this project?

- On whose traditional territories is this project taking place, and how can I meaningfully connect with these Indigenous groups at the onset of the project?

- How can we effectively reach everyone who should know about this project? (i.e., Think about the platforms your target groups already use including, newsletters, message boards, etc.)

- How will project outputs be communicated back to the culinary tourism community?

In general, good practices for connecting with diverse groups include communications that are:

- Accessible,

- Inclusive,

- Time sensitive, and

- Respectful to the needs of each group or individual (e.g., do not plan key communications with agricultural stakeholders during harvest season)

Tools and Resources

There are several tools and resources available to support project management. If you are working with project partners across multiple organizations, pick the project management tools and resources that everyone can easily access.

Common project management tools and resources include, Gantt charts, critical paths, timelines, calendar tools, and specialized project management software.

Research

Quality research is the basis of culinary tourism strategy development. It provides you with the information needed to chart the direction forward. Putting together a research plan that outlines research methods and activities across your project is essential. Your research plan should include primary and secondary research questions to guide all research activities and be based on the goals and objectives set at the onset of your project. It is important to keep your questions within the context of culinary tourism. Keeping this context in mind will ensure that you have a focussed research plan and contribute to a comprehensive research process and clear strategy.

Primary research questions are overarching to the entire project, whereas secondary research questions inform specific research activities. When compiled together, the answers to secondary research questions will help respond to the primary research question.

Sample primary research question:

How should the destination go about developing culinary tourism?

Sample secondary research question:

Who are the key players relevant to culinary tourism in the destination?

Once you decide on the research questions, you then choose how to collect required data. In other words, you can determine what methods and activities are best suited to collect the data to answer the questions. You will likely use both primary and secondary research methods to do this. Importantly, primary and secondary research methods are distinct from the primary and secondary research questions described above.

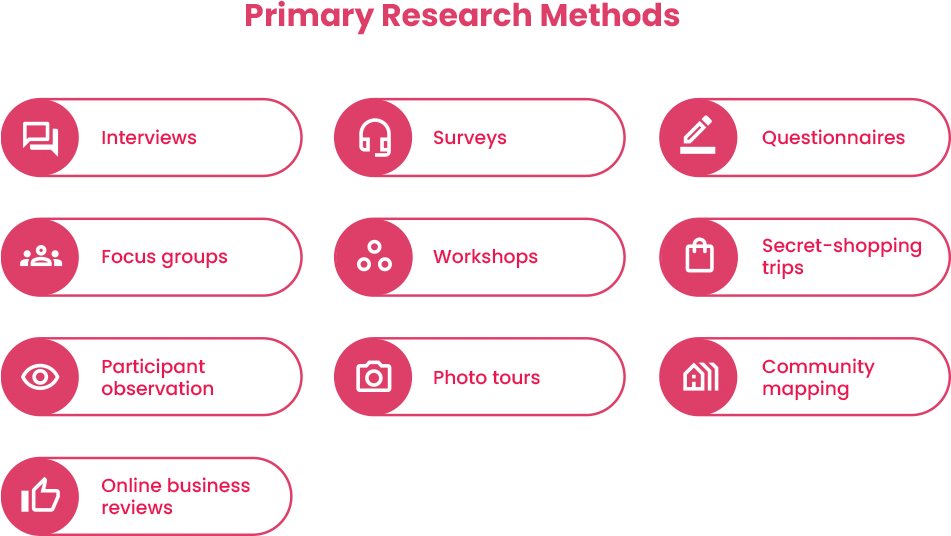

Primary Research

Primary research is when you collect data firsthand by engaging stakeholders, partners, government representatives, industry experts, and community members for research purposes.

Some primary research methods include:

- Interviews

- Surveys

- Questionnaires

- Focus groups

- Workshops

- Secret-shopping trips

- Participant observation

- Photo tours

- Community mapping

- Online business reviews

Community engagement is a key part of primary research for strategy development. When deciding which engagement techniques make sense for your project, remember to tailor these to the specific groups you are trying to reach. For example, if your target group lives in an area with poor internet-connectivity, an online video call is likely not the best way to connect.

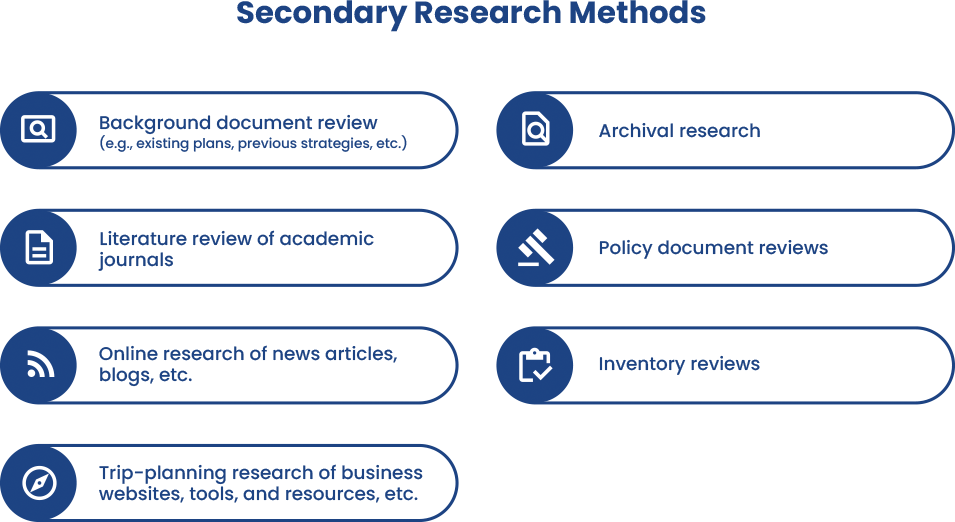

Secondary Research

Secondary research involves compiling data from research that already exists. In secondary research, you collect, analyze, and interpret data presented by someone else.

Secondary research does not require direct contact with stakeholders. Therefore, it is strategic to schedule secondary research at times when key stakeholders are otherwise occupied. For example, the tourism industry is often busy in the summer, so that is a good time to undertake low-engagement, secondary research activities such as the ones below:

- Background document review (e.g., existing plans, previous strategies, etc.)

- Archival research

- Literature review of academic journals

- Policy document reviews

- Online research of news articles, blogs, etc.

- Inventory reviews

- Trip-planning research of business websites, tools, and resources, etc.

Analysis and Planning

To define your strategy, you will need to analyze your research and data to begin planning the opportunities and actions of your strategy. During the analysis and planning phase you are addressing three big questions:

- Where are we now?

- Where do we want to be?

- What do we need to do to get there?

Analysis starts with making sense of all the research data by compiling it to draw conclusions about the current state. Next, you compare the current state to your desired future state as a way to identify gaps. Your desired future state is determined during goal setting at the start of the project or during the research phase via community engagement. Once you identify gaps, you create a plan to fill these gaps through actions set out over a timeline.

Determining the Current State

There are multiple approaches for analyzing research data. By consolidating your research and dividing the findings into predetermined categories you get a clear picture of culinary tourism development in your destination at the time of analysis. Some ways to organize your findings to describe the current state include:

| Type of Analysis | Finding Categories |

|---|---|

| Type of AnalysisSWOC Analysis | Finding CategoriesOrganize findings into four categories: Strengths, Weaknesses, Opportunities, Challenges |

| Type of AnalysisPESTLE Analysis | Finding CategoriesOrganize findings into six categories: Politics, Economy, Social, Technology, Legal, Environment |

After analyzing your research, you might notice that you have not adequately answered all the research questions. If this is the case, consider engaging in supplementary research to address this.

Identifying Gaps Between the Current State and Your Desired Future State

Once you have a clear understanding of the current state and your desired future state, you can identify gaps between the two states, as depicted in the table below:

| Objective | Current State | Gap | Desired Future State |

|---|---|---|---|

| ObjectiveTo increase the number of culinary tourism experiences in the destination | Current State50 culinary tourism experiences on offer | Gap25 more culinary tourism experiences needed to reach desired future state | Desired Future State75 culinary tourism experiences on offer |

| ObjectiveTo grow the number of visitors through new and enhanced culinary tourism offerings | Current State100 visitors per day | Gap100 extra visitors per day needed to reach desired future state | Desired Future State200 visitors per day |

| ObjectiveTo facilitate access to local food and drink at outdoor spaces and parks | Current State2 provincial parks in the area with shops 10 food and beverage producers in the vicinity of the parks |

GapNo mention of or access to local food and drink at the parks | Desired Future State5 local products available and featured at the provincial park shops |

Note: Not all future states will be easy to quantify, but it is important to attach indicators to your objectives so that their success can be measured. Additionally, not all future states need to point to an increase. Your future state may involve stronger connections between businesses and producers or the dispersal of tourists from one specific area of your region.

Strategy Planning

With a clear understanding of the gaps you need to fill to reach your desired future state, review your research data to identify areas of opportunity or pillars for development that can help you move to your desired future state.

Organize a strategy development session where you sit down with your project team to decide on broad strategies that can help you achieve your objectives. For example:

Is there a gap-filling opportunity to…

- improve destination marketing?

- grow industry capacity?

- develop new culinary tourism products?

- contribute to tourism dispersal across the region?

Making decisions within your project team and with stakeholders, a task force or working group, is a very important part of the strategy planning process. There are a number of ways to approach decision-making towards the development of your culinary tourism strategy:

- In-person decision making meeting

- Co-design session

- Online collector with gaps and preliminary areas of opportunity

Once the project team has a clear understanding of the broad area of opportunity, list the actions associated with each opportunity across a high-level timeline. This helps to ensure that the recommended actions are reasonable within the implementation timelines determined for the project. For example:

| Area of Opportunity | Actions (Year 1) | Actions (Year 2) | Actions (Year 3) |

|---|---|---|---|

| Area of OpportunityBuild capacity among industry | Actions (Year 1)Send informational newsletters about culinary tourism | Actions (Year 2)Host workshops for industry | Actions (Year 3)Host workshops for industry Organize a learning journey to a best practice destination |

The main outcome of this process will be a culinary tourism strategy document. How you present the strategy document, depends on who the main audience is. Additionally, if your plan needs to be approved by a municipal council, consider adding a short executive summary to make it easily digestible. If your plan is going to be shared with the broader public, think about how you can structure and design the report to make it easy for industry and other stakeholders to use. Equally important is paying attention to the language used across the strategy, aiming to avoid technical jargon.

Although the main output is a strategy report, you may also have additional tools and resources from the process as useful outputs such as a stakeholder database, inventory of culinary tourism businesses, as well as workshop or forum information and capacity-building materials on culinary tourism.

Implementation

Implementation is where the real work begins! This is where you and your partners make a plan for how to implement the actions outlined in the strategy report to fill gaps and seize the areas of opportunity identified to achieve your desired future state.

It is recommended that the implementation process be mapped out clearly across a detailed timeline that corresponds to the length of your strategy (e.g., 3-year strategy). This can be done through an implementation framework or action-planning tool. It is important that the method you select for implementation planning allows you and your partners to clearly understand the roles, related responsibilities, required resources, and expected outputs across implementation. When everyone knows their role and related expectations, it is more likely that your strategy can be effectively implemented.

Monitoring and Evaluation

Monitoring the progress of your strategy and evaluating the success of your objectives are important parts of culinary tourism strategy implementation.

One way to approach this is to refer to the process-oriented and outcome-based indicators you drafted when you identified your objectives. Using the indicators, you can develop evaluation tools and mobilize destination developers, industry, and other partners to collect data to evaluate the success of strategy implementation. This will allow you to evaluate whether or not the strategy worked to move your destination from the current state to your desired future state and identify areas that need adjustment.

Importantly, monitoring and evaluation of your strategy provides important data for reporting back to funders or supporting organizations. Additionally, when done with integrity and consistency you’ll be able to track the progress of your objectives toward understanding the larger impacts of culinary tourism development in your destination. Impacts are longer term effects of the changes you set through the implementation of your strategy. They will likely begin to manifest in 3 or more years after you begin implementation.

Collecting data throughout the implementation of your culinary tourism strategy allows you to monitor the roll out and measure its success against your goals using the key performance indicators.

Iteration and Adaptation

The results of your monitoring and evaluation will guide iteration and adaptation. Revisit your strategies for culinary tourism development periodically to decide if new approaches are needed based on changes to the current context. You will likely need to adapt or develop new strategies for culinary tourism development as time passes and your destination’s context changes.

Additional Resources

Please make sure to explore the Elevating Canadian Experiences platform for more industry-facing culinary tourism development resources as well as the list of resources below:

Tourism Industry Association of Canada, Resources

03 Assessing Your Readiness

Culinary Tourism Strategy Development

Guidelines

3

Timing

There is never a perfect time to proceed with the development of your culinary tourism strategy. No matter when you begin and end the process, there will be factors beyond your control that will affect it. These will influence when the research takes place, who you engage, what methods you use, how far you plan ahead, and ultimately, the strategies that you decide to pursue.

Times of crisis, such as the COVID-19 pandemic, only add to the impacts that external factors can have on strategy development. It is then important for you to anticipate as many of these as possible before you begin the process. Equally important is that you begin the process if you are ready, despite external factors. Having a plan for making food & drink a meaningful part of every visitor experience can help you to respond to change, build resilience in your destination, and empower your stakeholders. The key is to build flexibility into your methodology and process, so that you can be responsive to your environment, including the needs of tourism stakeholders in your destination.

Is it the right time for you to proceed with the development of a culinary tourism strategy?

Alignment

Culinary tourism, like any form of niche tourism, does not exist in a vacuum and should not be perceived as the solution for a destination working to develop and grow. Food & drink products and experiences are means to attract visitors and elevate the visitor experience. They can also be used to exceed the expectations of visitors motivated to come to your destination for other reasons.

Whether food & drink are your primary or secondary focus, it can be part of a more integrated approach to destination development, marketing, and stewardship. Put differently, your culinary tourism strategy may serve to refresh, supplement, or complement current, past or future tourism strategies.

How does growing culinary tourism align with your destination development plans?

Investment

Regardless of when you begin to develop your strategy, and whether it will become part of, or inspire a broader destination development plan, it is very important that you and your tourism stakeholders are invested in the process. You will need resources to develop your strategy, including time, energy, and effort. You will also need to ensure that those stakeholders who are best positioned to contribute to the strategy development process—and benefit from its implementation—are interested, willing, and able to support its development.

Stakeholder insights, input, and feedback are invaluable resources to you, and the future of culinary tourism in your destination will depend on whether key stakeholders were listened to and see themselves in the final strategy.

Significant investment will also be required to implement your strategy, and it is not expected that you are the sole source, so it is important to connect with strategic partners before, during, and after the strategy development process. Culinary tourism growth and development is a collaborative effort that requires ongoing investment from a breadth and diversity of actors.

Are you and your stakeholders ready to invest in culinary tourism development?

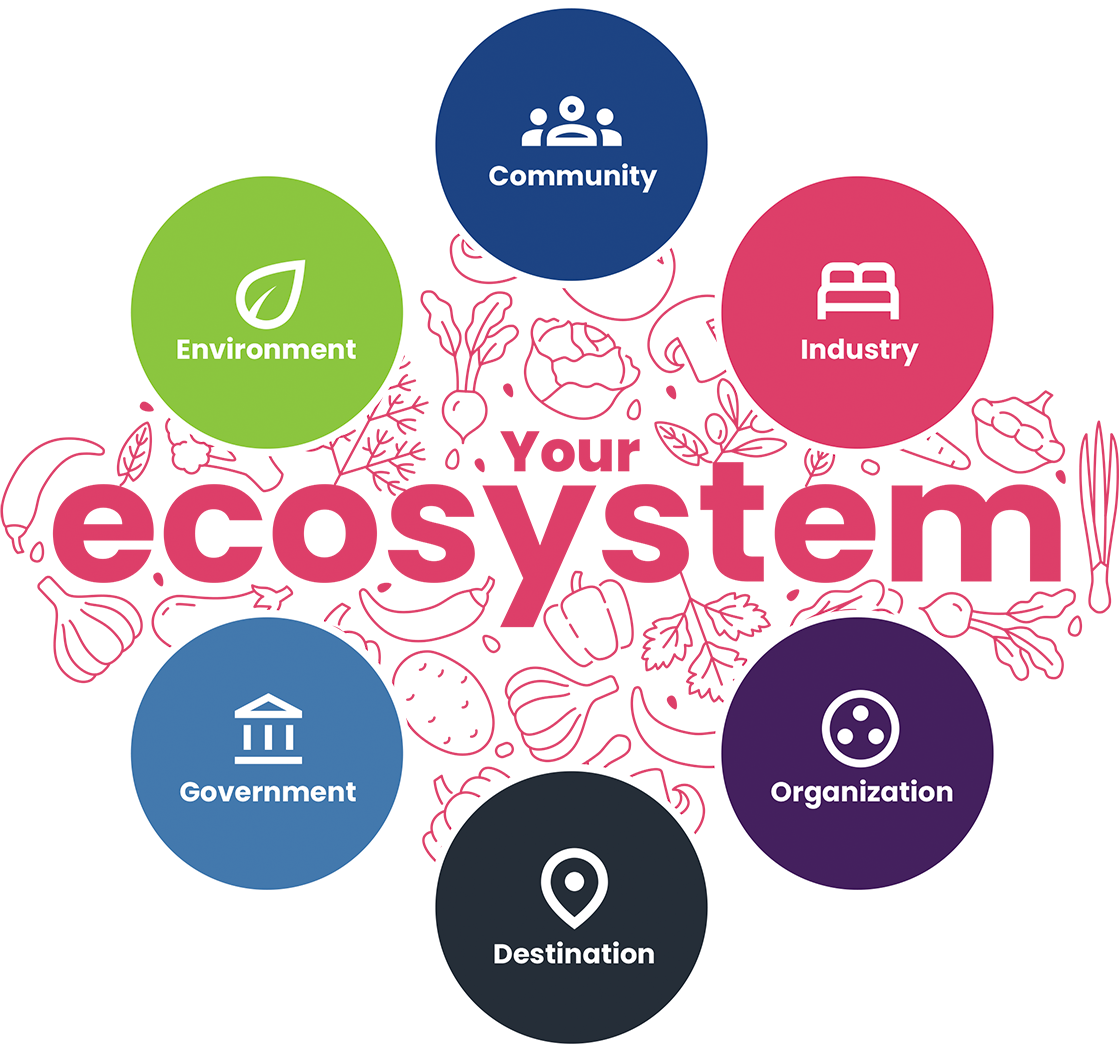

Ecosystem

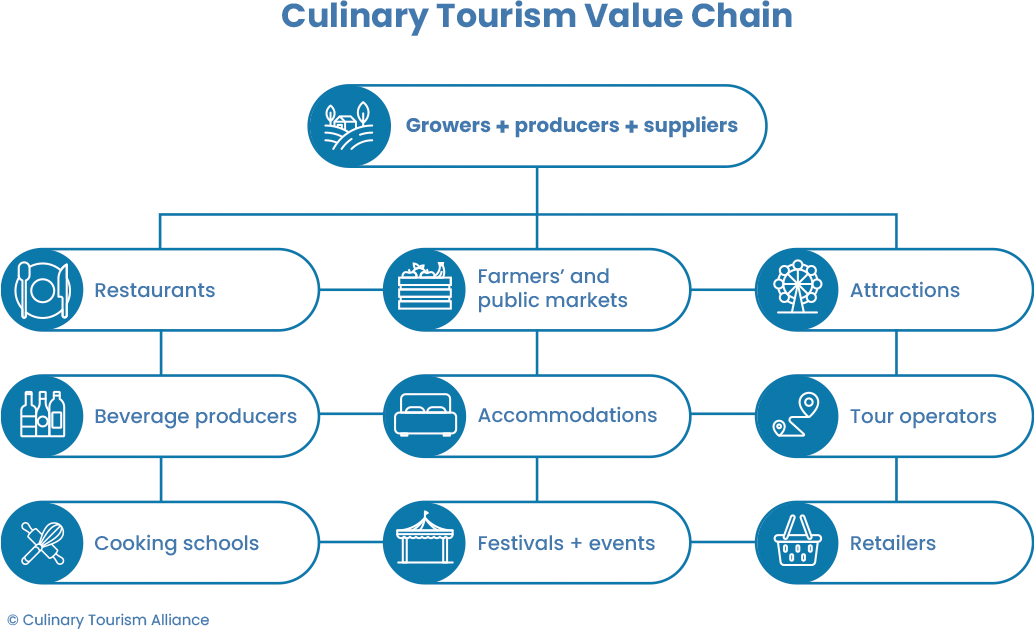

By definition, an ecosystem is a community that is made up of diverse actors interacting with their shared physical environment, and this is defined by a specific geographic area.

Considering that food & drink products and experiences are the manifestation of a community of stakeholders that have come together to celebrate their foodways with visitors to their place, it is both constructive and important to think of your culinary tourism strategy as the product of a tourism ecosystem.

Foodways address who, what, where, when, why, and how food becomes part of the fabric of a community. They shed light on the physical, social, cultural, economic, and spiritual factors that inform their experience of food.

In other words, your culinary tourism strategy needs to be situated within a context that includes the economy, society, and environment. Each of these areas are full of intangible and tangible assets you can leverage during the development of a culinary tourism strategy that is unique to your destination.

It is important to think about how cultures are currently and have been connected to your destination through food. Perhaps there are Indigenous-led projects that connect individuals to traditional territories and ingredients, or perhaps the rural area has a long history of agricultural production. With this in mind, there is a breadth and diversity of culinary tourism stakeholders, including individuals, businesses, and organizations that operate with your tourism ecosystem and need to be mobilized as part of your strategy development process.

Taking a whole systems approach to culinary tourism strategy development better positions you to connect your visitors to the rich food histories, heritage, cultures of your destination, and most importantly, to the people who bring these all to life through their traditions, practices, and stories. This will also help you build a strategy for culinary tourism development that is grounded on the amazing landscapes, buildings, and businesses that define your destination.

Each and every actor within your tourism ecosystem has a unique combination of capital, ranging from experiential and intellectual to financial and material, and everything in between. Your willingness to identify and leverage the pool of capital within your destination, in a responsible manner and to the benefit of all involved, will result in the development of a culinary tourism strategy that is greater than its parts.

The ecosystem from which your culinary tourism strategy will take shape

What does your tourism ecosystem look like and how can culinary tourism flourish within it?

02 Using the Guidelines

Culinary Tourism Strategy Development

Guidelines

2

The national guidelines have been developed to guide destination developers in rural and remote destinations in the process of preparing for, researching, and planning a culinary tourism strategy.

The guidelines are structured into four main components that can be used chronologically or as independent pieces. The components of the guidelines are guides to help you in assessing your readiness, setting goals and objectives, approaching strategy development, developing your culinary tourism strategy, and planning for implementation.

The contents of each component are not exhaustive nor prescriptive. Rather, the guidelines are a collection of learnings, good practices, and suggestions that you can leverage to develop your culinary tourism strategy.

As you work your way through the guidelines, keep your local context, intentions for culinary tourism development, the needs of your stakeholders, and previous tourism development work top of mind. Rural and remote destinations have the unique opportunity to leverage their unique settings and landscapes, healthy natural environments, rich histories and cultural heritage, agricultural traditions, and diverse communities of Indigenous Peoples, historic settler, and newcomers that live or have historically lived in the destination to grow culinary tourism.

A range of resources are included in references & resources to support you in understanding and pursuing culinary tourism strategy development.

01 Developing the Guidelines

Culinary Tourism Strategy Development

Guidelines

1

Acknowledging all First Nations, Inuit, and Métis peoples who were here before us, as well as those who live with us now, and the seven generations to come, is the starting place for all tourism development work in Canada. As Indigenous peoples have done since time immemorial, it is the responsibility of all to be stewards and caretakers of the lands and waters of the place they call home, and to respect the cultures, ceremonies, and traditions of all who reside there.

Indigenous foods and foodways are an integral part of tourism in Canada and Indigenous culinary products and experiences will continue to elevate the tourism landscape across Canada in the years to come. Through the combined efforts of several organizations, including the Indigenous Tourism Association of Canada, Indigenous Culinary of Associated Nations, and provincial and territorial industry organizations, along with Indigenous tourism businesses, Indigenous culinary tourism is strengthening Canada’s value proposition.

The Tourism Industry Association of Canada (TIAC), with funding from the Government of Canada’s Canadian Experiences Fund, worked with the Culinary Tourism Alliance (CTA) from 2019 to 2021 to develop the national guidelines for rural and remote destinations as part of the Elevating Canadian Experiences Program.

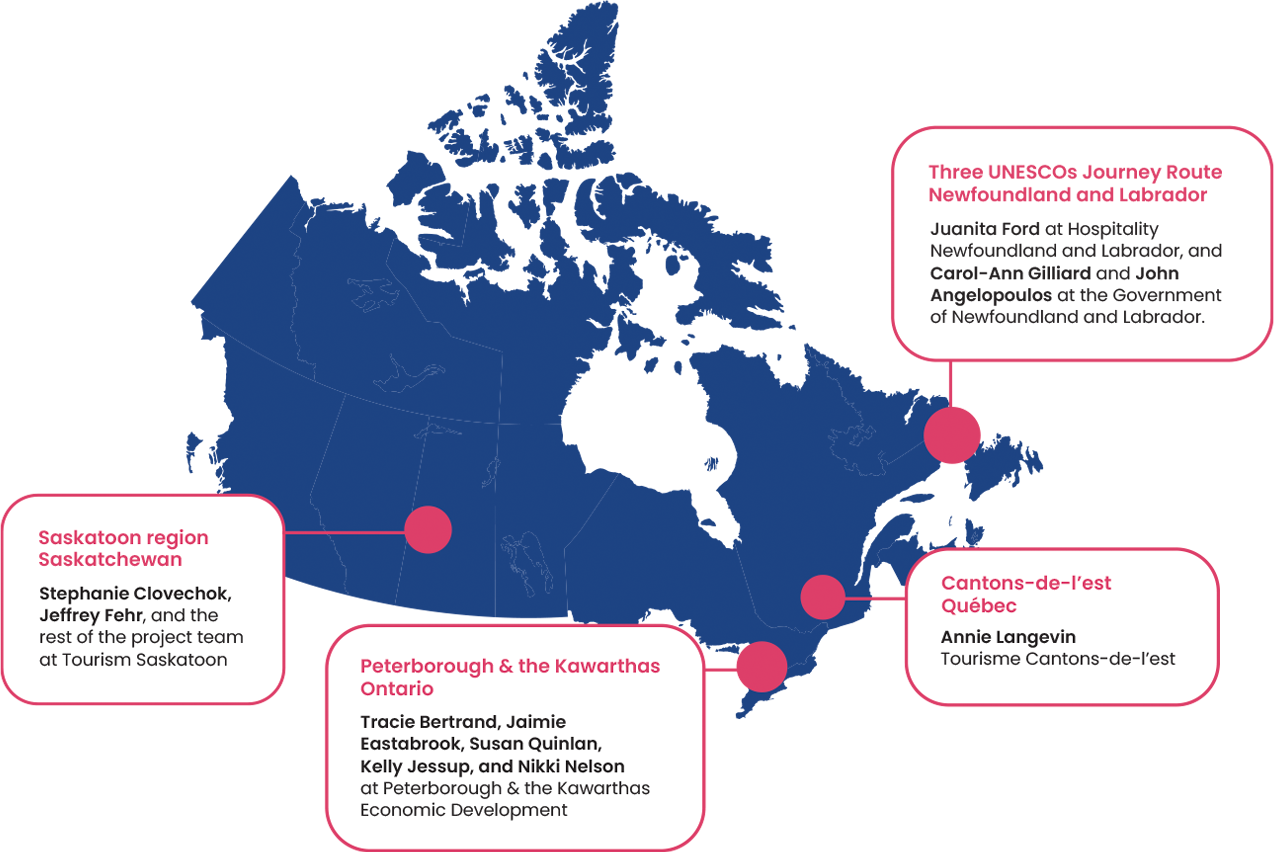

The CTA worked alongside municipal and provincial partners to co-develop four distinct and context-specific strategies to grow culinary tourism in four destinations. Across the four pilot destinations, the CTA formed four distinct teams to facilitate the strategy development processes. Importantly, each culinary tourism strategy was co-developed with tourism teams from the destination and employed a community-based participatory research approach. The guidelines would not have been possible without the dedication, energy, and efforts of the destination development teams at the four strategy development pilot destinations:

- Cantons-de-l’est, Québec

- Annie Langevin at Tourisme Cantons-de-l’est

- Peterborough & the Kawarthas, Ontario

- Tracie Bertrand, Jaimie Eastabrook, Susan Quinlan, Kelly Jessup, and Nikki Nelson at Peterborough & the Kawarthas Economic Development

- Saskatoon region, Saskatchewan

- Stephanie Clovechok, Jeffrey Fehr, and the rest of the project team at Tourism Saskatoon

- Three UNESCOs Journey Route, Newfoundland and Labrador

- Juanita Ford at Hospitality Newfoundland and Labrador, and Carol-Ann Gilliard and John Angelopoulos at the Government of Newfoundland and Labrador.

Additionally, the Alliance de l’industrie touristique du Québec, Hospitality Newfoundland and Labrador, the Tourism Industry Association of Ontario, and Tourism Saskatchewan were key partners in facilitating the connections with each regional partner and supporting the pilot process.

Before the start of the four pilot projects, the CTA conducted desk research into culinary tourism strategy development processes. This involved researching culinary tourism strategies or plans developed on or after 2015. A total of 16 culinary tourism strategies were analysed, these were focussed on rural and remote destinations and included a mix of six Canadian and 10 international examples. As part of this scan of methodologies, the CTA also referred to the United Nations World Tourism Organization’s Guidelines for the Development of Gastronomy Tourism (2019).

The resulting guidelines are informed by the above-mentioned research and by the methods, processes, activities, and learnings from the four culinary tourism strategy development pilots. Through each of the pilots the CTA used developmental evaluation to follow learnings and adjust each pilot, and ultimately to inform these guidelines. The developmental evaluation approach for the pilot was facilitated by Camilo Montoya-Guevara at the Culinary Tourism Alliance with support from Walter Jamieson, PhD. Adjunct Professor, Hospitality and Tourism Management, Ryerson University. Thank you!

Finally, this work would not have been possible without the combined time, energy, and effort of Connie Trombino and Vince Accardi at the Tourism Industry Association of Canada.

Culinary Tourism Alliance

The national guidelines were developed by a team at the Culinary Tourism Alliance, including Trevor Jonas Benson, Camilo Montoya-Guevara, and Caroline Morrow.

They were informed by learnings that came out of a pilot process and the combined experience of several additional individuals, including Martin Lacelle, James Arteaga, and Valerie Keast.

The Culinary Tourism Alliance is a not-for-profit industry organization dedicated to bridging the gap between the food & drink and tourism industries.

Tourism During COVID-19: March 2021

Report

Key Takeaways Snapshot

Health Impact

COVID-19 remains a serious global health threat and the situation continues to evolve, including the emergence of new variants in over 30 countries. Despite new variants, worldwide cases are declining. However, the risk to Canadians is still considered high. The border closure has been extended to March 21, marking a full year of suspended land movement. Travel restrictions continue to limit travel to Canada, with most foreign nationals unable to enter the country even if they have a valid visitor visa or electronic travel authorization (eTA). As of February 21, Canadians returning to Canada must meet new testing and quarantine requirements including mandatory quarantine at a government-approved hotel. Vaccine rollout continues world-wide, with the COVAX initiative officially underway and the AstraZeneca vaccine now approved in Canada.

Economic Impact

2020 was an incredibly difficult year for the Travel and Tourism industry, with the coronavirus outbreak reaching all countries and causing unprecedented levels of restrictive measures. The second spike in coronavirus cases in Europe and North America subdued momentum at the end of 2020 and into 2021. While governments have implemented a range of fiscal packages and policies to protect jobs and incomes during the pandemic, unemployment rates have increased and incomes have fallen. These pressures are likely to escalate as government support is gradually eased, and while there is clear and significant pent-up demand, citizens will become more considered with their travel decisions.

Vaccines and Travel

As domestic vaccination rates trend upward, more people are traveling or planning to travel. Broadly speaking, proof of vaccination in order to travel is not required, but it may be in the future depending on where one is travelling. As a means to reboot the decimated tourism industry, countries and industries are considering various vaccine health passes as prerequisites of entry and travel. However, the World Health Organization has come out against the idea of a COVID-19 vaccine certificates as vaccines are not available on an equitable basis.

Tourism is the heartbeat of Canada

Redirecting foreign spend power towards domestic and getting locals to grasp the importance of supporting local tourism businesses will be critical this year, particularly as 99% of businesses in Canada’s tourism sector consist of small and medium enterprises. By keeping their tourism dollars in Canada, Canadians play a critical role in bolstering the tourism economy, creating jobs and supporting local businesses.

Remote work visas: the future of work and travel

The remote work environment has advanced extremely fast due to the state of the world pandemic. Millions of workers now have the flexibility to work from anywhere they desire. With a huge portion of people working from home already, remote work is the present, and flexible working is the actual future of work and travel. Emerging remote work visa programs have the potential to create a much more sustainable form of tourism and could potentially transform how the world works and travels.

Canadian Resident Sentiment Toward Tourism

With ongoing COVID cases and new variants, Canadians continue to feel hesitant towards travel. As the distribution of the vaccine now underway, tourism recovery is expected to slowly return along with lifted public health measures and a broader economic rebound. The experience of the global pandemic has devastated the international travel market with no signs of recovery at any significant rate. Tourism recovery at the provincial level will continue to depend on how well COVID-19 is contained locally, vaccine distribution and efficacy, and how reliant each province is on international visitors.

Traveller Behaviours

When travel advisories are likely to be lifted or modified remains unclear. But, while the advisory remains in effect, there are still options for Canadians who choose to travel. It is more important now than ever to ensure that travellers understand their travel health insurance coverage and have the necessary coverage, as well as the mandated quarantine measures. International travel is a possibility this summer and the success of vaccine rollouts may allow for short-haul travel to resume between many economically developed nations. Although barriers are present, the rollout of a digital COVID Travel Pass will be beneficial to the global travel sector and will increase the likelihood of a meaningful start to recovery in 2021.

Aviation

Deep airline industry losses will continue into 2021, even though performance is expected to improve. Aggressive cost-cutting is expected to combine with increased demand, due to the reopening of borders and the widespread availability of a vaccine. Testing remains the immediate solution to meaningfully re-open air travel, and with 46 million jobs at risk in the travel and tourism sector alone because of air travel, fast, accurate, and scalable testing must become government priorities to give airlines the means to safely do business.

Accommodation & Events

The pandemic has had a huge impact on the accommodation and events sector, and while forecasts show some revival later this year, it is clear that the economy and business confidence is going to take time to recover.

Cruise

Globally, cruising will most likely make its long-awaited comeback early in 2021, with an overwhelming response for trial sailings and research showing that travellers are anxious to get back out on the water. When cruising returns, the experience will be different as extensive new health and safety protocols will need to be met. However, in Canada, the ban on cruise ships has been extended until 2022. By closing Canadian ports to passenger vessels for another year, the livelihoods of tens of thousands of Americans and Canadians are at risk from more job losses and further economic devastation.

Major Tour Operators

Tours are going to look different when travel restarts in earnest. Not only have tour operators made changes for safety circumstances, but travellers will also have increased options and the comfort of navigating a post-pandemic world with the help of guides and experts. Travellers are also looking to travel with a purpose and are looking for tours and destinations that allow them to get off the beaten path and discover new places – backed by flexible cancellation policies and industry certifications in health and safety.

Download the Full Report

Tourism During COVID-19: February 2021

Report

Introduction

This month’s dashboard is different from previous monthly dashboards in that it takes a step back from summarizing significant COVID-19 updates meant to support travel and tourism industry stakeholders in making the best decisions (though a brief summary is provided at the end of the report). Rather, it summarizes the numerous “trends” reports that have been published and circulated by major travel and tourism and other sector sources at the end of 2020/beginning of 2021 to help destinations, operators and travellers plan for 2021.

This month’s dashboard summarizes the top 21 trends, insights and predictions that those in the travel and tourism industry can expect in 2021.

Top Trends for 2021

2021 will be a year of slow transition. Barring any unexpected catastrophes and a continuation of vaccinations, individuals, the travel and tourism industry and society can slowly begin looking forward to shaping futures through a lens of innovation and opportunity.

This report focuses on the top 21 trends, insights and predictions from leading travel and tourism sources to support industry stakeholders frame the future of travel and tourism in 2021.

Top Trends for 2021

Embracing Working from Anywhere

Travel with Intention and Impact

The Return of Consumer Confidences

Hygiene Over Fees

The Rise of Rural

The Slow Travel Movement

Wellness Tourism

Travel is a Luxury

Last Minute Bookings

Travel Agent Value Surge

Younger Travellers

Business Travel Will Resume, Responsibly

No Fee Trip Changes

Supporting Local

Values-Driven Brand Authenticity

Digital Transformation

Cruise Control

“Vaxications”

Travel Testing, Proof of Vaccinations, and Quarantines?

Solo Travel Takes a Pause

Destination Asia

Download the Full Report

Developing Winter and Shoulder Season Tourism

Toolkit

Embracing Canada’s Winter and Shoulder Season

Use this industry-expert developed toolkit to help you imagine new possibilities for your tourism experience. Re-envision how you can uncover the untapped possibilities of broadening the shoulders of your tourism season with valuable insights, worksheets, tips and strategies.

Because after all, this beautiful country we call home is not just about the summer. There’s an incredible wealth of experiences just waiting to be discovered. So, what are you waiting for… let’s do it!

Modules

The Tourism Industry Association of Canada (TIAC), with funding from the Government of Canada’s Canadian Experiences Fund, worked with the Culinary Tourism Alliance (CTA) from 2019 to 2021 to pilot the development of culinary tourism strategies in rural and remote destinations.

The CTA worked alongside municipal and provincial partners to co-develop four distinct and context-specific strategies to grow culinary tourism in four destinations. Across the four pilot destinations, the CTA formed four distinct teams to facilitate the strategy development processes. Importantly, each culinary tourism strategy was co-developed with tourism teams from the destination and employed a community-based participatory research approach.

Case Studies

Click on any location to below to explore examples from around the world and here in Canada for building successful winter and shoulder season tourism opportunities. Find these and other important insights in the National Toolkit for Developing Winter and Shoulder Season Tourism.

Download the Full Toolkit

Our industry experts have developed a toolkit offering valuable insights, worksheets, tips, tools and strategies to help you take advantage of previously untapped tourism opportunities. Download the toolkit today and let’s turn your great ideas into action!

Tourism During COVID-19: December 2020 & January 2021

Report

Key Takeaways Snapshot

Health Impact

COVID-19 remains a serious global health threat and the situation is evolving daily. Given the number of cases in Canada, the risk to Canadians is considered high. As such, Canada’s borders will remain closed until at least January 21, 2021 with new protocols coming into effect that will mandate all air passengers entering the country to provide proof of a negative COVID-19 test. However, the measure will not replace the federal government’s mandatory 14-day quarantine period, and testing procedures are yet to be explained. Further testing protocols at land points of entry are also being explored in collaboration with provincial health authorities, but issues of complexity have prevented testing policy implementation thus far.

Economic Impact

The pandemic has brought global travel to a halt, grounded many flights, and left seafarers stranded onboard ships for months—leading to disrupted supply chains and fragile economies. Coordinated global action is urgently needed to safely reopen borders and restore the movement of essential goods and workers across the land, air, and sea borders. For global travel and trade to return to prepandemic levels safely, travelers, governments, and industries will need a harmonized, standardsbased model for health status verification.

The Alberta International Border Testing Pilot Program

Some destinations in Canada are testing the feasibility of a testing upon arrival program to shorten the amount of time travellers need to quarantine once they arrive in the destination. The pilot program being tested in Alberta including the Calgary airport is demonstrating success in the possibility of reducing the amount of time that travellers from outside Canada would need to quarantine. Other provinces are eyeing Alberta’s program to test in their own airports.

WestJet-YVR COVID-19 Testing Study

Destinations are tracking research that is being conducted by the University of British Columbia, Providence Health Care, WestJet and the Vancouver Airport Authority to investigate a method of ora rinse rapid-testing for COVID-19 to inform the safest and most effective way of testing departing passengers prior to security screening at Vancouver International Airport (YVR). This approach is yet another way that some destinations are re-thinking travel during COVID-19.

Toronto’s Pearson International COVID-19 Testing Project

A recent academic study conducted by McMaster HealthLabs (MHL) in collaboration with Air Canada, the Canadian government and Toronto’s Pearson International Airport focussed on testing arriving international travellers with a gold standard PCR test that issues results within 48 hours. Preliminary results of the study demonstrate 70% of infected passengers would be detected on arrival.

Canadian Resident Sentiment Toward Tourism

With rising COVID-19 cases, Canadians are feeling less safe to travel close to home and within their own provinces compared to November. With the distribution of the vaccine now underway, tourism recovery is expected to commence along with lifted public health measures and a broader economic rebound. The experience of the global pandemic will reshape both domestic and international travel patterns and preferences, with the expectation that traveller confidence will remain subdued for at least the next two years. Tourism recovery at the provincial level will depend on how well COVID-19 is contained locally and how reliant each province is on international visitors.

Traveller Behaviours

Extended scenarios for 2021–2024 developed by the United Nations World Tourism Organization (UNWTO) point to a rebound in international tourism by the second half of 2021, however a return to 2019 levels in terms of international arrivals could take two to four years with traveller confidence remaining at a record all time low due to slow virus containment and travel restrictions. Domestic demand is expected to recover faster than international demand, and thus remains the focus for recovery efforts.

Aviation

International air travel remains more than 90% down compared to 2019 levels as a result of travel restrictions, leading to huge job losses across the global economy. The aviation industry is calling for consultation with governments and a coordinated COVID-19 testing approach. The utilization of testing is seen as a major element of the path forward to save the aviation industry and protect public health.

Accommodation & Events

The pursuit of risk-based and data-driven approaches to COVID-19 testing is key to obviate the need for quarantines and travel bans that are decimating the accommodation and events industry locally, and worldwide. Establishing common criteria and thresholds for determining epidemiological risk, implementing common protocols to best mitigate risk, and implementing comprehensive, cost effective pre-departure testing procedures and contract tracing protocols are widely seen by industry members as viable alternatives to automated quarantines.

Cruise

As the world continues to address the challenges regarding COVID-19, the top priority for the entire cruise community, including cruise lines, travel agents, ports, destinations and suppliers, continues to be the health and safety of passengers, crew and the communities they visit with a focus on benefiting from the guidance of national authorities in regions where cruising has started to resume–particularly Europe and parts of the South Pacific.

Major Tour Operators

Innovative travel safety initiatives are emerging, giving rise to a new shape in the tourism sector. However, many countries around the world are still extremely cautious about easing travel restrictions– especially in light of the new stain of COVID-19. Staying up to date with the latest information, and supporting advocacy campaigns will be paramount heading into 2021.

Download the Full Report

Tourism During COVID-19: November 2020

Report

Key Takeaway Snapshot

Health Impact

Canada’s borders will be closed until at least January 21, 2021. Vaccines, along with promising new strategies that involve testing visitors for COVID-19 prior to departure or upon arrival on flights and international border crossings are anticipated to have a positive influence on border re-openings and may significantly limit mandated traveller quarantine periods. To reduce the spread of COVID-19, Canadian airports can look to Rome’s Fiumicino Airport, the first airport in the world to earn “the COVID-19 5-Star Airport Rating” from Skytrax, an international airport industry ratings body. Although Skytrax is best known for its annual rankings of the world’s best airports, the global pandemic prompted the organization to come up with a designation for airport hygiene.

Economic Impact

Tourism plays a significant role as one of the world’s most important economic sectors, providing livelihoods to hundreds of millions of people while boosting economies and enabling countries to thrive. It is imperative that international governments work together to harmonize global policy, lift restrictions and rebuild the tourism sector for it to regain its position as a provider of decent jobs, stable incomes and for the protection of cultural and natural heritage. In the meantime, tourism businesses need to take advantage of all government support available to survive the second wave and prepare for 2021.

Yarmouth and the Acadian Shore: 3-year strategy

The vision is to unlock Yarmouth and Acadian Shores in the winter/shoulder by taking the steps to becoming a year-round destination, especially for Atlantic Canadians.

They will be encouraged to do more and see more of the winter/shoulder products and experiences, which will step up their overall satisfaction and increase their likelihood of returning.

The vision will be achieved by balancing the needs of the people and institutions of Yarmouth and Acadian Shores and visitors, with the recognition of the importance of the visitor economy and benefiting from the expansion of the season.

Anantara Veli Resort, Maldives

Traditional destination marketing models are being replaced by creative offerings that capitalize on travel restrictions. Visionary destinations have the opportunity to emerge as industry-leaders targeting new types of travellers and shaping the future of tourism. Early adaptors can differentiate themselves by creating unlimited, remote working and ultimate social distancing packages with little to no market competition.

Canadian Resident Sentiment Toward Tourism

Despite rising COVID cases, most Canadians still feel reasonably safe to travel close to home and within their own provinces with the exception of those in BC and Ontario. Local travel remains the strongest opportunity for the Canadian tourism industry. Canada’s internal travel restrictions are likely contributing factors to perceptions of safety abroad. As community-based tourism model, targeting local and some close domestic visitors will support the highest levels of traveller confidence, local tour operators can focus on generating business through the “staycation model” and increase revenues by offering products and experiences tailored to each season.

Traveller Behaviours

Younger populations are the demographic most likely to engage in near-future, longer-term travel, and therefore may be a key audience to focus on in 2021. As Canadians are not travelling internationally, building back confidence in inter-provincial travel will continue to be paramount in the coming months. Provinces can monitor the success of the ArriveCAN program and potentially develop similar inter-provincial programs to increase positive sentiment towards domestic travel.

Aviation

As countries around the world work to overcome the COVID-19 pandemic and restart their economies and tourism, they all face the challenge of how to reopen their borders and allow international travel to resume while protecting their populations’ health. The current patchwork of policies and ever-changing border entry and health screening requirements has made international travel more complex, leaving airlines and border agencies uncertain about the validity of test results and passengers unsure of what is being asked of them. Emerging programs like the World Economic Forum’s (WEF) CommonPass Program or China’s QR code-based global travel system represent the opportunity to develop and launch standard global models to enable people to securely document and present their COVID-19 status (either as test results or an eventual vaccination status) to facilitate international travel and border crossing while keeping their health information private. Recognizing that countries will make sovereign decisions on border entry and health screening requirements, including whether or not to require tests or what type of test to require, these programs can serve as a neutral platform which creates the interoperability needed for the various ‘travel bubbles’ to connect and for countries to trust one another’s data by leveraging global standards.

Accommodation & Events